| Personal Credit Cards | Secured Credit Cards | Student Credit Cards | Business Credit Cards | |||

| Compare Credit Cards | Search All Credit Cards | Cash Back Debit Cards | ||||

Cash Back Debit Cards |

Published: Dec 13, 2022 Updated: July 8, 2025 |

|

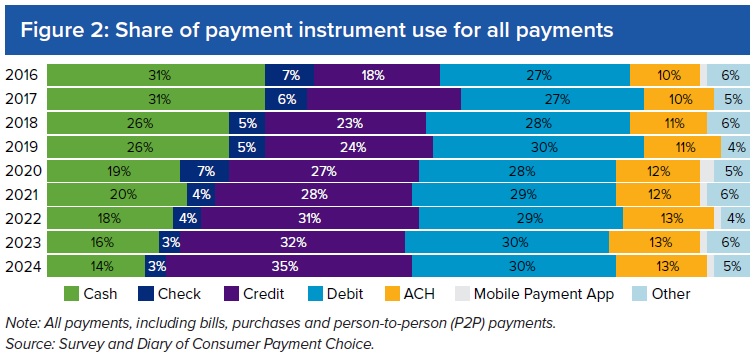

We love maximizing credit card rewards, but debit cards are still the most popular type of payment in the United States. The good news is we are now finding debit card options with interesting rewards that fill key gaps. First let’s start with the key benefits of all debit cards. Debit card transactions are deducted directly from your bank account so the spending limits are set by what you deposit into your account. With debit cards, you can’t accumulate huge amounts of debt and there are no interest fees. Opening a new account with a debit card will have no impact on your credit score or credit history. There will be no “hard” credit pull and no change to your credit utilization. Depending on your current situation, the impact to your credit score may be a huge concern or may be no concern at all. Now let’s look at the best current options for cash back debit cards. |

|

All of the cash back debit cards listed above can be linked to high yield savings accounts which allows you to take advantage of high interest rates while also being able to cover debit transactions. These debit cards also have no overdraft fees. Some of the cards will decline transactions if there aren't enough funds in your account, while others will allow you to overdraft up to a certain limit before declining transactions. Both options are better than the large overdraft fees charged by most banks. We would rather have a debit card declined at Starbucks versus paying $40 for one cup of coffee.

Merchants that charge fees for credit card transactions will often accept debit cards with no fees or much lower fees. This is where using a debit card with cash back rewards will really pay off. Take for example your property taxes. If you use any credit card to pay your property taxes, you may be charged over 2% in fees which will wipe out any cash back benefits. If you use a debit card to pay your property taxes, there may be a flat $2.50 fee but the 1% cash back will be much greater than the fee. There are many similar cases where using a 1% cash back debit card is better than using a 2% cash back credit card.

The last key benefit to mention about these debit cards is their merchant offers. Fintech startups have partnered with many different types of merchants to provide aggressive offers in order to attract customers. At this time, Upgrade has the most popular national brands to choose from which makes it very easy to plan your spending and they also have offers for dining at small local restaurants. Varo has a few national brands but their focus is on smaller brands. You can see more details for each card including all current merchant offers at the links above.

Choosing your next credit card can be a tough decision, but that doesn’t have to be a concern with debit cards. We have ALL of these cards and use the best benefits of each card at different times.

BankMindful.com is an independent publisher and comparison service. The content on Bank Mindful is for informational and educational purposes only and should not be construed as professional financial advice. Should you need such advice, consult a licensed financial or tax advisor. We do our best to keep information updated, however, numbers stated on this site may differ from actual numbers. We may have financial relationships with some of the companies mentioned on this website. BankMindful may not include all companies or all available products.